In This Issue:

Additional Items:

By: Herb Decuers, CIC, ARM, CRIS

By: Herb Decuers, CIC, ARM, CRIS

Underwriter, Insure Response

It has been a year since Insure Response began working with Big “I” Markets to provide continuation of the Non-Standard Homeowners program and we couldn't be happier with the reception and support from the Big “I” Markets agencies.

Recent underwriting changes have been made and new products designed that we believe will help us increase your book of business and provide coverage to consumers in your areas that would otherwise not have access to coverage.

-

Coverage A minimum reduced to $150,000 in all states with the exception of Louisiana and Michigan

-

Coverage C minimum on condos and HO-4s lowered to $20,000

-

Now able to endorse at a flat fee

-

Cyber liability coverage

-

Accident insurance for your insured's pets

Our goal this year has been to work with all parties for a quicker turn-around time. We have done this by closely monitoring the process from the beginning and following through to policy issuance. The underwriting team at Insure Response is educating agents about any documentation that is needed prior to quote submission and working closely with the carrier underwriters for continuous follow up and confirming that they have all they need to approve and issue policies.

As we move toward the 4th quarter of 2015 and into 2016, we will continue our efforts to provide superior service as well as winning your confidence to ensure that Big “I” Markets and Insure Response are your broker of choice for efficiency, courtesy, knowledge and professionalism.

Recent Successes:

-

Older homes 25 years or more

-

Slate or Wood Shakes Roof

-

Dwellings Owned in Trusts or LLC's

-

Dwelling subject to wind mitigation. We understand what features these homes need to have (hip roof, roof straps, shatter proof glass, and storm shutters) and work to secure the proper credit for wind exposed properties.

-

Accounts with losses

-

Rental Properties- Full annual rentals, vacation rentals or weekend, weekly & monthly durations. We are also a market for Secondary residences that are rentals.

-

Unprotected dwellings- we will consider PC 9 & 10 dwellings.

-

Log Homes

-

Lex Share Home Rental Coverage- Unique coverage extensions for Rental or "Shared" dwellings.

Learn more about the Non-standard Homeowner or Rental Dwelling, Non-standard Condominium Owner, Non-standard Renters or Vacant Dwelling - Non-standard at www.bigimarkets.com.

________________________________________

Free Caliper Webinar

By Elif Wisecup Director of Marketing of Big I Advantage®

Whether you're a large or small company, we all face the same challenges when it comes to hiring: how do I hire the right person the first time and ensure that they will be a true fit?

Whether you're a large or small company, we all face the same challenges when it comes to hiring: how do I hire the right person the first time and ensure that they will be a true fit?

Join Caliper for a free webinar on Thursday September 17, 2015 at 12:00 p.m. EST, entitled The 3 Best Practices for Hiring Top Performers.

In this free webinar, you'll get practical tips from Caliper I/O Psychologist, Ric McLellan, PhD. and Talent Management Consultant, Stepheny Booker on:

-

How to build a robust and effective hiring process

-

The three best practices for hiring the right fit

-

How to ensure hiring success in the future

You’ll gain valuable insights on developing an effective hiring program for new employees. Doing so will alleviate your hiring concerns as well as save you time and money. Learn how to hire right the first time.

________________________________________

Do you ever watch Guy Fieri's Diners, Drive-ins & Dives on the Food Network? It highlights great, bizarre, and iconic restaurants all over the U.S. Most of these places offer unique or distinctive styles and dishes. Most of them are known for one or more of their unique dishes, barbeque, or a secret sauce. Some of the places are located in gas stations, a factory, and even an old church. The variety of cuisine offered varies greatly even with in the same episode. Caribbean, French, Korean, Middle Eastern, German, Peruvian, American, Vietnamese, Mexican, Tex-Mex and dozens more, plus some strange combinations of two or more.

Do you ever watch Guy Fieri's Diners, Drive-ins & Dives on the Food Network? It highlights great, bizarre, and iconic restaurants all over the U.S. Most of these places offer unique or distinctive styles and dishes. Most of them are known for one or more of their unique dishes, barbeque, or a secret sauce. Some of the places are located in gas stations, a factory, and even an old church. The variety of cuisine offered varies greatly even with in the same episode. Caribbean, French, Korean, Middle Eastern, German, Peruvian, American, Vietnamese, Mexican, Tex-Mex and dozens more, plus some strange combinations of two or more.

A lot of these places would qualify for our Restaurant Casual Dining Pac - Travelers Select product designed for fast food and family style restaurants with up to 2 locations, up to $1.5million Total Insured Value per building, up to $2million Total Annual Sales per policy and up to $600,000 Total Annual Payroll. Eligible classes include:

A lot of these places would qualify for our Restaurant Casual Dining Pac - Travelers Select product designed for fast food and family style restaurants with up to 2 locations, up to $1.5million Total Insured Value per building, up to $2million Total Annual Sales per policy and up to $600,000 Total Annual Payroll. Eligible classes include:

-

Asian Fast Food

-

Drive-In (Service in Car)

-

Food Courts

-

Mexican Take Out

-

Pizza Fast Food

-

Subs and Sandwich Take Out

-

All Other Fast Food

-

Asian Family Style

-

Buffet

-

Cafeteria

-

Italian Family Style

-

Other Ethnic Cuisine Family Style

-

Pizza Family Style (no delivery)

-

Seafood Family Style

-

Steak Barbecue Family Style

-

All Other Family Style

Restaurant Pac is currently available on Big "I" Markets to member agents in all states except AK, FL, HI, LA, RI & TX.

_______________________________________

"Certificates of Insurance" - 2015 Edition

September 16, 2015

1:00 to 4:00 p.m. Eastern Time

$79 - Click here to register

Some agents have placed information or specifically requested wording on certificates of insurance, compliance checklists, or agent affidavits that include knowingly incorrect information. Sometimes it is well meaning and trying to save a customer from losing a job or a paycheck for completed work. Sadly, in some cases there are likely agents who do it when more law-abiding and ethical agents won't so that they can keep or get the business. This Big "I" Virtual University webinar continues the Certificate of Insurance conversation and covers where the problems most often begin; additional insureds; contractual insurance requirements…what can or can't you do; other issues and more with q&a time.

Also planned is the October webinar on CGL Contractual Liability Issues in the Construction Industry. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

Know your Line of Business: Earthquake

By Paul Buse, President of Big I Advantage®

Recently, I noticed a broadcast of National Public Radio's Diane Rehm talk show she focused on risk of Earthquakes in the Pacific Northwest. Then I saw a RoughNotes article on this Line of Business (LOB). In the article was an Insurance Information Institute estimate that 7% of homeowners carry earthquake insurance. That figure surprised me and I hope it's true…as low as a 7% is. How would your book look on penetration of this peril?

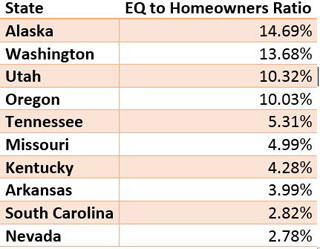

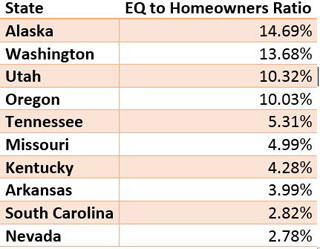

To share some figures with you, I looked at the second largest writer of earthquake insurance in the USA, State Farm. I skipped over the largest writer, the California Earthquake Authority (CEA) because that business is 100% generated in California. The State Farm book of EQ business is in every state and DC. This lets you examine the ratio of earthquake premiums to homeowners. Below are the top ten states for State Farm, and the ratio in those states of EQ premiums to homeowners. Please note: excluded from the below are California, Texas and Florida where State Farm Homeowners premiums are harder to draw any comparable figure from.

Click Graph for larger version

Source: Source: NAIC InsuranceData for 2014 State Farm Fire & Casualty and State Farm General Insurance Companies.

Click Graph for larger version

Source: Source: NAIC InsuranceData for 2014 State Farm Fire & Casualty and State Farm General Insurance Companies.

Consider this! On average State Farm adds the equivalent of 1.6% of premiums for every homeowners premium dollar. To an independent agent, performance like State Farm is the equivalent of adding a second profit sharing payment to your agency. Do you routinely offer EQ? Do you use DocuSign to get signed rejections when coverage is declined? Asking for signed declinations is a sure-fire way to increase sales of products like EQ, umbrellas, and pollution/environmental.

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

ACE Top Ten Boating Safety Tips

-

Certificates of Insurance - 2015 Edition

-

Big "I" Flood Program

________________________________________

By: Herb Decuers, CIC, ARM, CRIS

By: Herb Decuers, CIC, ARM, CRIS Whether you're a large or small company, we all face the same challenges when it comes to hiring: how do I hire the right person the first time and ensure that they will be a true fit?

Whether you're a large or small company, we all face the same challenges when it comes to hiring: how do I hire the right person the first time and ensure that they will be a true fit? Do you ever watch Guy Fieri's Diners, Drive-ins & Dives on the Food Network? It highlights great, bizarre, and iconic restaurants all over the U.S. Most of these places offer unique or distinctive styles and dishes. Most of them are known for one or more of their unique dishes, barbeque, or a secret sauce. Some of the places are located in gas stations, a factory, and even an old church. The variety of cuisine offered varies greatly even with in the same episode. Caribbean, French, Korean, Middle Eastern, German, Peruvian, American, Vietnamese, Mexican, Tex-Mex and dozens more, plus some strange combinations of two or more.

Do you ever watch Guy Fieri's Diners, Drive-ins & Dives on the Food Network? It highlights great, bizarre, and iconic restaurants all over the U.S. Most of these places offer unique or distinctive styles and dishes. Most of them are known for one or more of their unique dishes, barbeque, or a secret sauce. Some of the places are located in gas stations, a factory, and even an old church. The variety of cuisine offered varies greatly even with in the same episode. Caribbean, French, Korean, Middle Eastern, German, Peruvian, American, Vietnamese, Mexican, Tex-Mex and dozens more, plus some strange combinations of two or more.